Controllable costs are expenses managers have control over and have the power to increase or decrease. Controllable costs are considered when the decision of taking on the cost is made by one individual. Common examples of controllable costs are office supplies, advertising expenses, employee bonuses, and charitable donations. Controllable costs are categorized as compound interest calculator short-term costs as they can be adjusted quickly. Accounting software automates the tracking and classification of costs; hence, there is a minimal need for manual input and, this in turn, minimizes human errors.

Get in Touch With a Financial Advisor

These activities are also considered to be cost drivers, and they are the measures used as the basis for allocating overhead costs. Direct cost drivers like raw materials are quite easy to allocate to products, but it is more difficult to accurately identify how each activity contributes to indirect costs. A good example of an ABC application would be finding out how employees split their time on the job.

Examples of Cost Accounting

Cost accountants use accounting software and ERP software to carry out their tasks and roles. For example, a property bought twenty years ago for $50,000 is sure to have appreciated. But if the company operates under historical accounting principles, the property will still be recorded as $50,000 on the balance sheet. Due to this discrepancy, some companies use a mark-to-market basis to record assets in their financial statements.

These details enable the management team to eliminate or adjusted gross income definition to pull back on any activities that do not generate a sufficient amount of profit. The importance of cost accounting is a function of the seven points discussed below. To achieve this, planning and use of the standard for each item of cost is needed, which ensures that deviations can be identified and, accordingly, and corrected. In the age of competition, the objective of a business is to maintain costs at the lowest point with efficient operating conditions. Cost accounting is helpful because it allows executive management of companies to understand how to use their resources more effectively by tracking and measuring them and studying their effects.

Company

Automation enables organizations to use fewer resources to attain cost accounting accuracy. Typically follows standard inventory valuation methods to ensure consistency and comparability in financial reporting across periods. It emphasizes the broader financial performance and position of the company, summarizing revenues, expenses, and profitability.

During the 19th and 20th centuries, with the advent of mass production and the complexity of modern manufacturing processes, there was a demand for the development of more advanced techniques of cost accounting. With time, cost accounting underwent many innovations that helped businesses get better control over their operations and thus firmly established cost accounting as a crucial function within organizations. The early industrial revolution, when businesses were getting larger and more complicated, is where the origins of cost accounting lie. Cost accounting evolved over time to suit the dynamic needs of the expanding business enterprises.

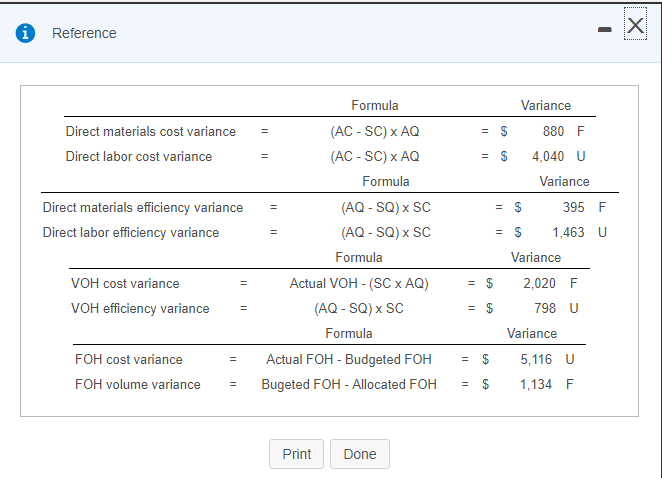

By analyzing it, the manager can know which added costs are avoidable and how to avoid them. The difference between both costs is called variance and can be positive or negative. Opportunity costs are only used when determining which option out of multiple choices of investment is most viable. “Throughput”, in this context, refers to the amount of money obtained from sales minus the cost of materials that have gone into making them. Wafeq’s cutting-edge solutions align with global best practices and are designed to streamline your accounting needs. Our solution has conceptual framework accounting the ability to record transactions, which will be automatically posted into the ERP, automating 70% of your account reconciliation process.

- In this blog, we will understand what cost accounting is, its key purposes, its formulas and types , with practical examples.

- All activities involved in production are divided based on their individual costs.

- Advanced accounting software automates a majority of cost accounting processes, reducing manual efforts required for data entry, and hence offering real-time insight into costs.

- This allows the accounts team to focus on strategic decision-making and higher-value activities.

- Sunk costs are historical costs that have already been incurred and will not make any difference in the current decisions by management.

- Value streams are the profit centers of a company; a profit center is any branch or division that directly adds to a company’s bottom-line profitability.

Cost accounting information is also commonly used in financial accounting, but its primary function is for use by managers to facilitate their decision-making. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided. However, the electricity used to power the plant is considered an indirect cost because the electricity is used for all the products made in the plant.

Our Financial Close Software is designed to create detailed month-end close plans with specific close tasks that can be assigned to various accounting professionals, reducing the month-end close time by 30%. The workspace is connected and allows users to assign and track tasks for each close task category for input, review, and approval with the stakeholders. It allows users to extract and ingest data automatically, and use formulas on the data to process and transform it. Highly flexible, adapting to the specific needs of the business and its internal decision-making processes. Generally categorizes costs into broad classifications like revenues, expenses, assets, and liabilities, providing an overall financial picture. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.