Fees to your brief account is actually another grounds to look at before you wade Diy. Bank- https://vogueplay.com/in/white-rabbit/ possessed brokerages tend to costs $one hundred per year to the RRSPs you to definitely wear’t see their lowest account proportions conditions—generally $15,100 otherwise $twenty-five,one hundred thousand, according to the broker. Certain may charge large change income should your balance is actually less than a specific threshold.

— Jim think a costly fitness center subscription may help encourage your in order to end becoming an inactive since most of one’s exercise equipment try associated with televisions. Could you imagine the meaning of your own passive idiom merely by the looking at the image? A couch potato is actually a famous phrase in the American English so it is worth studying. Find out about the brand new standards i used to assess position online game, that has many techniques from RTPs so you can jackpots.

Observe that these model profiles is a number of different targets to possess carries and ties. Old-fashioned people is always to spend some a heightened to share to bonds (which can be less risky) much less in order to holds. Aggressive traders usually takes a lot more exposure because of the allocating a top proportion in order to brings. Most buyers would be better-served by a well-balanced collection out of somewhere within 31% and you may 80% brings.

- While you are there’s no make certain for the inverse relationship, it’s fundamentally recognized you to definitely holding holds and securities together with her produces a good lower-exposure profile.

- The online game is made in such a way which seems because the complete package, because the history blue serves as a comparison against all loving tones which might be put on screen.

- Canadian Inactive tends to make lots of great recommendations for traders that want to manage their investments.

- We’re also maybe not gonna generate a visit on the rates of interest to the an initial-label basis, however, given the listing low prices, they really simply have you to definitely place to wade, that is right up.

- In such instances, people could possibly get state such things as “he’s become a couch potato for too much time”, demonstrating that they need to get up and begin active much more.

For those who’lso are using $ten every time you get or offer an ETF, you ought to hold back until you have got at the very least $2,000 or so prior to a transaction. Let’s begin by handling your own fear of losing the ability to decide which ETFs to sell to cover your own typical distributions. For individuals who keep multiple finance, it’s correct, you could blend the detachment bundle along with your rebalancing method. For example, if you would like withdraw $25,100 in the RRSP, you need to find out and this advantage classification try very obese from the collection, and slender one carrying. For many who’re over weight holds, then you definitely would be to sell certain carries in order to take back the newest $25,100000.

RSSY ETF Review – Go back Stacked U.S. Brings & Futures Give ETF

Those individuals clients who enjoyed the notion of incorporating devoted rising cost of living-attacking possessions were rewarded. I ought to remember that the new rising prices-attacking possessions—for example merchandise, gold and you can product carries—may not be expected when you’re from the buildup stage, meaning you’re also building up your profile. Over-long periods out of 15, 20 years or more, stock places make a wonderful inflation hedge. Inside the senior years, otherwise as we strategy the brand new retirement exposure zone, avoiding near-identity rising prices risks is very important. Next, let’s go through the performance of the advanced inactive portfolios at the individuals exposure membership.

Do it dos: Role Enjoy

When Browne developed the Long lasting Profile on the mid-eighties, it wasn’t such as very easy to perform your self. Browne recommended splitting your finances just as certainly stocks, long-name authorities bonds, gold and money. All of these ETF profiles below is Canadian holds, Us carries, and around the world stocks (out of both establish and you may emerging counties), providing wide exposure to the worldwide equity business. He is balanced by an enthusiastic allocation so you can ties to attenuate volatility and you will risk. Picking out the suitable blend of carries and you will ties is one of important choice your’ll need to make. My personal associates Justin Bender and you can Shannon Bender are creating an excellent videos to make this very important alternatives.

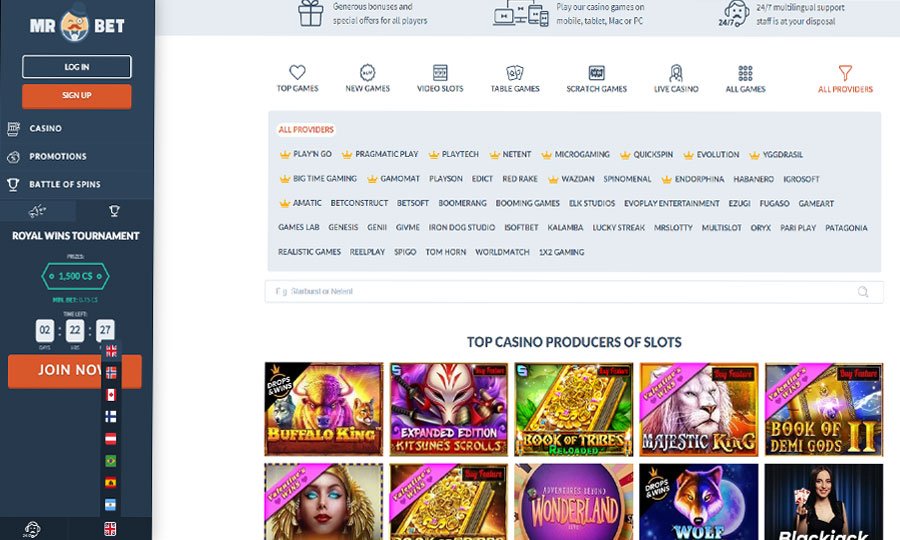

Looking to help make your individual Passive portfolio having list money or ETFs? Eventually, just remember that , language evolves through the years and you can definitions can alter. When you are “inactive” has been in existence for several many years today, the usage can get shift as the public thinking to the free time and you can production always progress. Within the sets, get transforms acting out situations where someone is a good “passive” and the almost every other is wanting to motivate these to wake up and take action effective. If an online local casino generally seems to force a down load on you, it’s skeptical.

This period considers inception go out to your ETF possessions available. And also the begin day coincides to your start of rising prices fears during the early 2021. The new Vanguard collection is the laggard, since the all-community ETF it offers 10% connection with emerging segments.

Our take a look at would be the fact that the on line video slot doesn’t render almost sufficient spins bonuses to guarantee an area to the one user’s list of favorites. When you are there are some professionals which will discover the brand new totally free spins bonuses getting somewhat beneficial, we believe that players was better off seeking out almost every other online slots with more lucrative bonus has. Couch potato funding income generated to the a corporation, simultaneously, is actually taxed during the an individual predetermined fee around 50% within the Ontario, otherwise near the large marginal tax rates. Couch potato income tax prices are very highest as the Canada Money Company (CRA) doesn’t require me to features an unjust income tax advantage by spending all of our portfolios to the companies. Register for CNBC’s on line path Ideas on how to Earn Couch potato Money On the web to know about preferred couch potato money channels, tips to begin and you will real-lifetime success tales.

The sofa Potato slot is an excellent choice for anyone looking to own a top-quality on the internet slot machine game which have a decreased-risk foundation. Withholding tax from you at the corporate top very first hits the new purpose of reducing any advantage you might have because of the broadening your own investment capital in the firm versus. myself. Moreover it produces fairness in that you are not double taxed on that investment money when taking the bucks from your company as the a dividend. Offered this type of higher prices, you could wonder if you should bring the bucks away of one’s holding team and purchase it personally, particularly if their mediocre individual taxation rate is lower than simply 50%. As an alternative, you might imagine applying a secured asset-allocation ETF services. These types of “all-in-one” ETFs are available in various other stock/thread allocations for the chance tastes, and they are global varied.

The brand new Canadian stock exchange did well overall, due to times and commodities visibility. All resource try negative in the 2022, apart from the true asset money. I have to admit I questioned the difference reciprocally between such 2 portfolios as much better. Amazingly, your butt Potato Profile attained a lower CAGR compared to S&P five hundred, with approximately 50 percent of the new volatility, far shorter drawdowns, and much greater risk-modified get back (Sharpe).