Understanding Accounting Rate of Return ARR

For example, if the minimum required return of a project is 12% and ARR is 9%, a manager will know not to proceed with the project. If you’re making a long-term investment in an asset or project, it’s important to keep a close eye on your plans and budgets. Accounting Rate of Return (ARR) is one of the best ways to calculate the potential profitability of an investment, making it an effective means of determining which capital asset or long-term project to invest in. Find out everything you need to know about the Accounting Rate of Return formula and how to calculate ARR, right here. To get average investment cost, analysts take the initial book value of the investment plus the book value at the end of its life and divide that sum by two.

Access Exclusive Templates

ARR is the annual percentage of profit or returns received from the initial investment, whereas RRR is the required rate of return that the investor wants. ARR estimates the anticipated profit from an investment by calculating the average annual profit relative to the initial investment. Unlike other widely used return measures, such as net present value and internal rate of return, accounting rate of return does not consider the cash flow an investment will generate. This can be helpful because net income is what many investors and lenders consider when selecting an investment or considering a loan.

Ask Any Financial Question

In today’s fast-paced corporate world, using technology to expedite financial procedures and make better decisions is critical. HighRadius provides cutting-edge solutions that enable finance professionals to streamline corporate operations, reduce risks, and generate long-term growth. The Record-to-Report R2R solution not only provides enterprises with a sophisticated, AI-powered platform that improves efficiency and accuracy, but it also radically alters how they approach and execute their accounting operations. The main difference between ARR and IRR is that IRR is a discounted cash flow formula while ARR is a non-discounted cash flow formula. ARR does not include the present value of future cash flows generated by a project. In this regard, ARR does not include the time value of money, where the value of a dollar is worth more today than tomorrow.

It is crucial to record the return on your investment using programs like Microsoft Excel or Google Sheets to keep track of it. If you are using excel as a tool to calculate ARR, here are some of the most important steps that you can take. In this example, there is a 4% ARR, meaning the company will receive around 4 cents for every dollar it invests in that fixed asset. This 31% means that the company will receive around 31 cents for every dollar it invests in that fixed asset.

Rather than looking at cash flows, as other investment evaluation tools like net present value and internal rate of return do, accounting rate of return examines net income. However, among its limits are the way it fails to account for the time value of money. It is a useful tool for evaluating financial performance, as well as personal finance.

In addition, ARR does not account for the cash flow timing, which is a critical component of gauging financial sustainability. The Accounting Rate of Return formula is straight-forward, making it easily accessible for all finance professionals. It is computed simply by dividing the average annual profit gained from an investment by the initial cost of the investment and expressing the result in percentage. The accounting rate of return (ARR) is a formula that shows the percentage rate of return that is expected on an asset or investment. This is when it is compared to the initial average capital cost of the investment. The Accounting Rate of Return (ARR) is a corporate finance statistic that can be used to calculate the expected percentage rate of return on a capital asset based on its initial investment cost.

To calculate accounting rate of return requires three steps, figuring the average annual profit increase, then the average investment cost and then apply the ARR formula. Accounting Rate of how to calculate contributed capital Return (ARR) is the average net income an asset is expected to generate divided by its average capital cost, expressed as an annual percentage. It is used in situations where companies are deciding on whether or not to invest in an asset (a project, an acquisition, etc.) based on the future net earnings expected compared to the capital cost. Average accounting profit is the arithmetic mean of accounting income expected to be earned during each year of the project’s life time. Average investment may be calculated as the sum of the beginning and ending book value of the project divided by 2. Another variation of ARR formula uses initial investment instead of average investment.

- Unlike other widely used return measures, such as net present value and internal rate of return, accounting rate of return does not consider the cash flow an investment will generate.

- Delivered as SaaS, our solutions seamlessly integrate bi-directionally with multiple systems including ERPs, HR, CRM, Payroll, and banks.

- Businesses generally utilize ARR to compare several projects and ascertain the expected rate of return for each one.

Find out how GoCardless can help you with ad hoc payments or recurring payments. Working with an adviser may come with potential downsides such as payment of fees (which will reduce returns). There are no guarantees that working with an adviser will yield positive returns. The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest. The Accounting Rate of Return is the overall return on investment for an asset over a certain time period. In investment evaluation, the Accounting Rate of Return (ARR) and Internal Rate of Return (IRR) serve as important metrics, offering unique perspectives on a project’s profitability.

How to Calculate ARR?

The ARR formula calculates the return or ratio that may be anticipated during the lifespan of a project or asset by dividing the asset’s average income by the company’s initial expenditure. The present value of money and cash flows, which are often crucial components of sustaining a firm, are not taken into account by ARR. Accounting rate of return (also known as simple rate of return) is the ratio of estimated accounting profit of a project to the average investment made in the project. By comparing the average accounting profits earned on a project to the average initial outlay, a company can determine if the yield on the potential investment is profitable enough to be worth spending capital on.

Advantages and Disadvantages of ARR

We’ll now move on to a modeling exercise, which you can access by filling out the form below.

Overall, however, this is a simple and efficient method for anyone who wants to learn how to calculate Accounting Rate of Return in Excel. If you’re not comfortable working this out for yourself, you can use an ARR calculator online to be extra sure that your figures are correct. EasyCalculation offers a simple tool for working out your ARR, although there are many different ARR calculators online to explore.

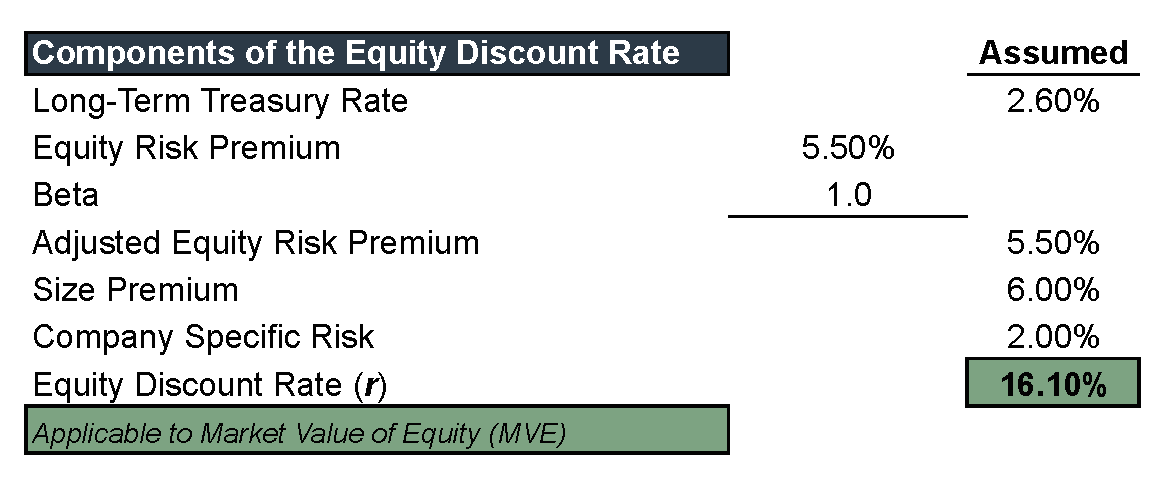

The ARR is the annual percentage return from an investment based on its initial outlay. The required rate of return (RRR), or the hurdle rate, is the minimum return an investor would accept for an investment or project that compensates them for a given level of risk. It is calculated using the dividend discount model, which accounts for stock price changes, or the capital asset pricing model, which compares returns to the market. how to calculate fixed cost To arrive at a figure for the average annual profit increase, analysts project the estimated increase in annual revenues the investment will provide over its useful life. Then they subtract the increase in annual costs, including non-cash charges for depreciation.